Kudimoney, rebranded as Kuda has been licensed for mircofinance and mobile banking services.

The banking licence by the Central bank of Nigeria(CBN) has propelled the financial technology company for the launch of a unique digital bank services in the country..

With the microfinance banking licence from the Central Bank of Nigeria, the financial technology company has rebranded its services to more seamless fintech solutions and it also changed its name to Kuda to strongly differentiate its brand.

According to Babs Ogundeyi and Musty Omotosho, who are Co-founders of the tech company, the Kuda’s launch is a timely one, as excess bank charges have become a constant source of worry for Nigerian bank customers.

Last year, the Central Bank of Nigeria recovered over N65 billion as illegal charges wrongfully deducted from customers’ deposits and other transactions within the banking system.And also discovered that commercial banks as at 2018 had charged customers N143 billion as account maintenance fees.

The founders said digital bank operation will offer frustrated consumers a more mobile, modern approach to traditional banking at a seamless experience like never before at a cost free model.

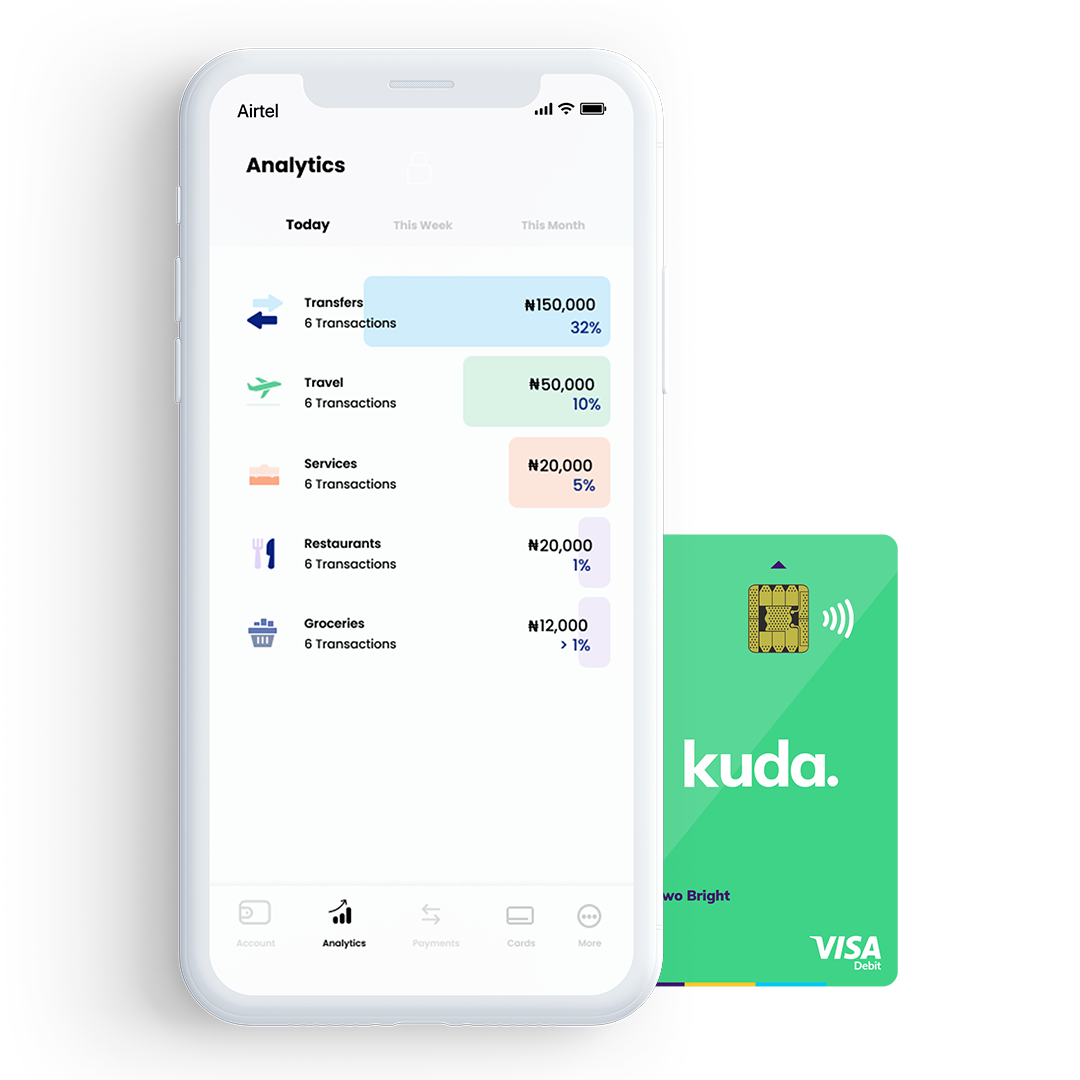

Their promise to customers is simple. “Unlike traditional banks, Kuda does not rely on banking fees, does not profit from members’ misfortune or mistakes, and actually helps members get ahead financially. Kuda members receive a debit card, a Spending & Savings Account, and an app that keeps them in control of their finances at all times, no matter where they are located.

“We’re excited to usher in a new era in consumer banking and serve the many Africans, who we believe are frustrated with traditional banks said Babs Ogundeyi, Co-founder & CEO of Kuda. Starting with Nigeria, we’ll launch a new kind of bank with a continued focus on improving our members’ financial lives rather than trying to burden them with hidden fees and excessive charges,” they said.

The banking license means Kuda can offer current accounts as well as debit cards – something it is already doing with a small group of alpha users. The bank is now in a pre-launch phase for the next couple of months. The rollout will initially consist of a few thousand cards, supported by a waitlist in preparation for a wider launch in the third quarter of 2019.

READ ALSO; NCC Grants Telecos Freedom to Pursue CBN E-payment Licence

About Kudabank

Kuda is a digital, mobile-only bank that helps consumers avoid bank fees, save money automatically, and lead healthier financial lives.

Founded by financial and tech industry veterans Babs Ogundeyi and Musty Omotosho, Kuda offers its members a Spending Account, an optional Savings Account, Kuda Visa® Debit Card, and a powerful mobile app that gives them complete control of their finances. The Kuda mobile app will be available for the iPhone® and Android devices.

The company received its microfinance banking licence from the Central Bank of Nigeria in 2018 and launches its mobile app and debit card to customers in Q3 2019.

To learn more about Kuda visit www.kudabank.com