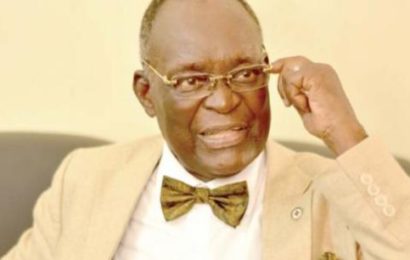

A legal practitioner, Dr. Charles Mekwunye has asked the Court of Appeal sitting in Lagos to retrain telecoms operator, MTN from listing its shares in the Nigeria Stock Exchange pending the determination of a suit between him, the telecom giant and four other firms.

In the appeal delineated as CA/L/1349/16, Dr. Mekwunye is seeking an order of interlocutory injunction restraining MTN, its agents or licenses from listing its shares in the Nigeria Stock Exchange or any globally recognized stock exchange pending the determination of his appeal.

Mekwunye had dragged MTN before the Federal High Court sitting in Lagos over the breach of a contractual agreement by firms representing the company in a privately placed share units offer.

Joined in the suit a co-defendants were Lotus Capital Ltd, Stanbic IBTC Asset Management Ltd, IHS Holding Ltd and INT Towers Ltd.

Mekwunye had contended at the Federal High Court that after buying about 5,000 MTN Linked Units share through MTN’s nominee, Stanbic IBTC Asset Management Ltd via a private placement memorandum, the firm failed to fulfil its obligation of converting the share units into MTN Nigeria shares.

But ruling on a preliminary objection raised by MTN on the competence of the suit, presiding Judge, Justice Mojisola Olateru asked parties in the suit to explored the arbitration clause embedded in the disputes contract.

Dissatisfied with the ruling of the lower court, Mekwunye through a motion on notice filed on February 26, 2018 approach the Court of Appeal.

Mekwunye insisted in the appeal papers that the crux of the matter is the failure of the respondents to list MTN shares in Nigeria Stock Exchange in 2013 as agreed by parties and that until the suit or appeal is properly determined, MTN ought not be allowed to list is shares at the stock market.

In an affidavit in support of the motion on notice, the Appellant averred that sometimes in February, 2008, Lotus Capital and Stanbic IBTC Asset Management via a private placement memorandum, represented that MTN International was offering to allocate shares of MTN Nigeria to the Nigerian public as investors through private placement arrangement.

According to the deposition, Stanbic IBTC Asset Management which was appointed as nominee for the MTN linked offer, subsequently engaged Lotus Capital Ltd to procure investors.

Mekwunye subsequently bought 5,000 units of the shares at the rate of US$122,800 in the then Naira equivalent of N18, 376, 800.

The appellant averred that the nominee structure as spelt out in the agreement papers was to last for three months after which the shares will be transferred to an exit special purpose vehicle which will then be exchanged for MTN Nigeria shares.

According to the appellant, at the end of three years, the respondents failed to create the agreed exit SPV on the ground that MTN International is already quoted on the Johannesburg Stock Exchange.

He further averred that the respondents opted to create an alternative exit mechanism which is neither listed on the Nigeria Stock Exchange without his consent or knowledge.

Mekwunye claimed that series of deductions were made on his share units by the respondents in the new agreement which he never gave his consent.

The prayers sought by the appellant includes; an order of interlocutory injunction restraining MTN, its agents, servants, privies, employees, licensees from listing its shares in the Nigeria Stock Exchange or any globally recognized stock exchange pending the final determination of his appeal.

An order of interlocutory injunction restraining MTN or its agent from putting up signs, advert or notice which may suggest the listing of its shares in the Nigeria Stock Exchange or any globally recognized stock exchange

An order of interlocutory injunction restraining MTN or its agents from putting up advertisements inviting the members of the public to buy or purchase it shares in any public offer in Nigeria pending the determination of the appeal.

The appellant is also asking the court to reverse the interference of IHS Holding and INT Tower in the agreement between him, MTN, Lotus Capital and Stanbic IBTC Management Ltd.

No date for hearing has been fixed for the matter.